Content

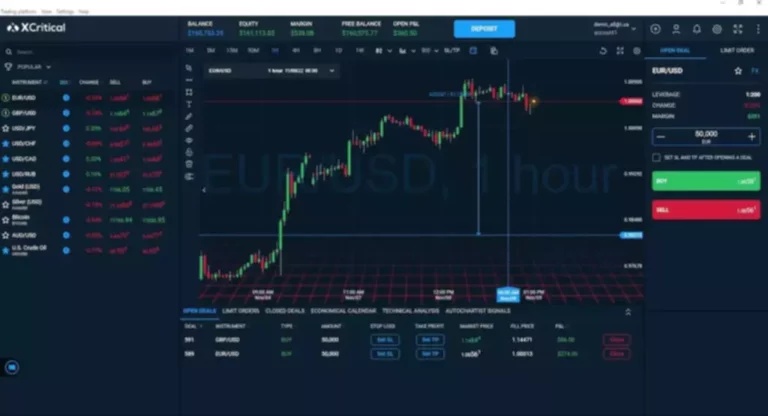

The comprehensive trading platform gives you access to a massive range of securities worldwide, including access to 150 global markets. Cryptocurrency exchange It is renowned for its extensive market access and professional trading tools, making it ideal for active and global traders. On the other hand, SoFi’s Active Investing accounts are totally self-directed, so you can decide exactly how to divide up your capital between different ETFs and stocks. Like many of the other best stock trading apps we’ve assembled here, SoFi is commission-free so you can make as many trades as you want without paying a cent.

Compare and find the broker that’s right for you

Personally, I prefer to stick with Tier-1-regulated brokers because they are governed by regulatory bodies like the FCA and CySEC. These regulators provide retail traders with the assurance of a compensation scheme, which protects your capital up to a certain amount in the event of a broker default. You can trade using a broker’s forex demo account which will trading platform design allow you to test the different fees and accounts available.

Cost to Build the Best Trading App

Our team of experts analyzed what makes a great forex trading platform, and I am sharing the key factors they discovered to be the most crucial. During https://www.xcritical.com/ our live fees test, I found the spread for EUR/USD during the London and New York trading session averaged 1.1 pips which is around the industry average of 1.0 pips for a commission-free trading account. FP Markets is an Australian forex broker founded in 2005 and is regulated by ASIC, CySEC, and the FSCA with one unregulated entity based in St.Vincent and the Grenadines (SVG).

Which trading platform is good for professional traders?

Robinhood is a brokerage platform that offers commission-free trading for stocks, options and cryptocurrencies, making it an excellent choice for cost-conscious investors. It is popular because it’s designed to give the average investor professional-level tools. Interactive Brokers (IBKR) is a long-standing favorite of experienced traders.

Use our account finder & get matched to your prefect investing, trading or currency account.

Day traders can also benefit from the services offered by various financial entities like small businesses, startups, and enterprises. Clients, customers, and consumers are key players in the financial market, affecting market dynamics. Promotions, deals, and discounts offered by these entities can provide financial opportunities and advantages for traders. Insurance products like home and auto insurance provide financial protection, which is crucial for day traders to safeguard their personal assets.

Brokers and brokerage firms are central to day trading, providing access to financial markets and necessary trading resources. Banks and other financial institutions also play a role, often facilitating transactions and sometimes offering trading platforms. Credit unions, while not typically directly involved in day trading, can offer financial services that support traders’ broader financial needs. Day trading strategies are as diverse as the traders employing them, yet all demand platforms that align with their specific needs.

All in all, the scope to gain a huge amount of money and fame is high when you decide to build a stock market app. A stock trading app is a cloud-based platform widely used to buy, sell, and manage stocks. All you need to perform these tasks is a smartphone and high-speed internet connectivity, and you are ready to begin your trading journey with the push of a few buttons. Currently, Alexandra works remotely from Algeria as a finance specialist for PipPenguin, a leading financial services company. In this role, she leverages her extensive experience and knowledge to provide valuable insights and guidance to clients worldwide.

TradeStation Global’s web platform is suitable also for not so advanced users. One of the brokers using Interactive Brokers securities execution services is Zachs Trade, with account opening availble globally for most countries. There are also a few brokers covered below, who use Interactive Brokers securities clearing services, meaning you get the same choice of instruments with a different fee structure. Previously though, you had to pay a $10 monthly inactivity fee, making it a bit more expensive or at least more suitable for those who have more invested already or invest on a monthly basis. Since July 2021 however, you no longer ned to worry about the $10 monthly minimum fee, making it one of the most competitive brokers out there. Managed portfolios consist of ETFs based on risk tolerance and timeframe.

- So, you might as well not have limits at the beginning with an account minimum.

- You can trade or place limit orders directly from a chart or you can click on the bid-ask quote at the top of the page in the 360 view.

- It involves monitoring system performance, stress testing, security testing, etc.

- But you also need a solid plan and the discipline to invest regularly and consistently to give you the best chance at building your wealth.

- With CFDs, you can ‘buy’ (go long) the shares if you think the stock’s price will rise, or you can ‘sell’ (go short) if you think the stock’s price will fall.

Trading systems and signals are often pushed by social media influencers, and others, as a way to make profits without putting in the effort. This means knowing the size of each position, and the maximum downside on each trade. The margin requirements for each trade and the effect that pledging margin, both initial and variation will have on their account balances.

Mobile trading is rapidly evolving, driven by new technologies and changing investor preferences. I see key innovations that make trading easier and more accessible for all investors. Be sure the app you choose to trade stocks has no account minimum as you might not have a significant amount of money at the start.

As per a top software development company, the process of stock market application development is not over even after launch. You will have to analyze your users’ feedback and keep making changes to the app and adding some features that your customers are still looking for. Additionally, platforms like SoFi Active Investing integrate educational resources directly into the app. As these technologies advance, mobile trading becomes not only easier but smarter.

۵۱% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. EToro is the best online broker for both new and active traders looking for a unique social trading platform with a user-friendly interface and low fees. When you buy regularly, you’re less susceptible to make emotional decisions based on greed and fear. While everyone needs to learn to manage their emotions in the markets themselves, I have pinned down the best low-cost brokers in the world. I focused on the ones that offer a great choice and low fees especially for investing in ETFs and secondly in stocks.

Loan and credit services, such as mortgages, student loans, auto loans, and home loans, can have a significant impact on a day trader’s financial planning and risk management. Credit cards, including student and debit cards, are often used for funding trading accounts or managing short-term financial needs, while payment cards offer additional flexibility for financial transactions. In the fast-paced world of day trading, choosing the right platform is akin to selecting a reliable partner in this financial journey.

They also have their own fee structure for trades, which is one of the cheapest I’ve seen. Interactive Brokers has a slight edge for US stocks, but transactions on international markets are significantly more affordable for both stocks and ETFs. If you are mostly interested in the US market, check out another Australian broker Stake in the world section. For a higher fee (typically 0.6% with a €۳۰ minimum) you can instruct MeDirect to execute trades on your behalf. They will probably recommend that you invest in funds with a higher cost than index funds/ETFs, but if you insist they will still buy the low-cost index funds you ask for. For most of us, it probably makes more sense to trade ourselves, but if you want to automate the process (and avoid keeping track of short-term movements of your investments) it may be worth the extra cost.

Trading is one of the riskiest types of investing because it involves taking large risks for large rewards. As such, and as you will see on risk warnings that are required by the FCA to be published on all trading platforms and trading advertising, up to 80% of those that try trading lose money. Good Money Guide takes the financial safety and protection of our visitors seriously. That’s why on this page you’ll only find online trading platforms that are regulated by the FCA, and where your funds are protected by the FSCS.